- Being paid weekly is not a disadvantage. On the contrary, it can help you stay on budget.

- Create a list of weekly expenses.

- Commit to your budget.

- Use cash.

- Create a savings account.

- Ask your employer for direct deposit.

- Set Specific Goals For Your Money

- Separate Needs And Wants

- Pay Off Debt Immediately

- Divide Your Money Into Categories

- Put Money Towards Savings

Budgeting on a weekly paycheck differs from budgeting on a biweekly or monthly paycheck. But you can do it with these easy steps!

Being paid weekly is not a disadvantage. On the contrary, it can help you stay on budget.

Being paid weekly can be a disadvantage, but it doesn’t have to be. If you’re paid every two weeks, it’s easy for your paycheck to go from $1,000 in one week to $0 the next. However, if this happens too often, you may spend more than what you earn because of unexpected expenses or debt payments due at certain times each month.

Create a list of weekly expenses.

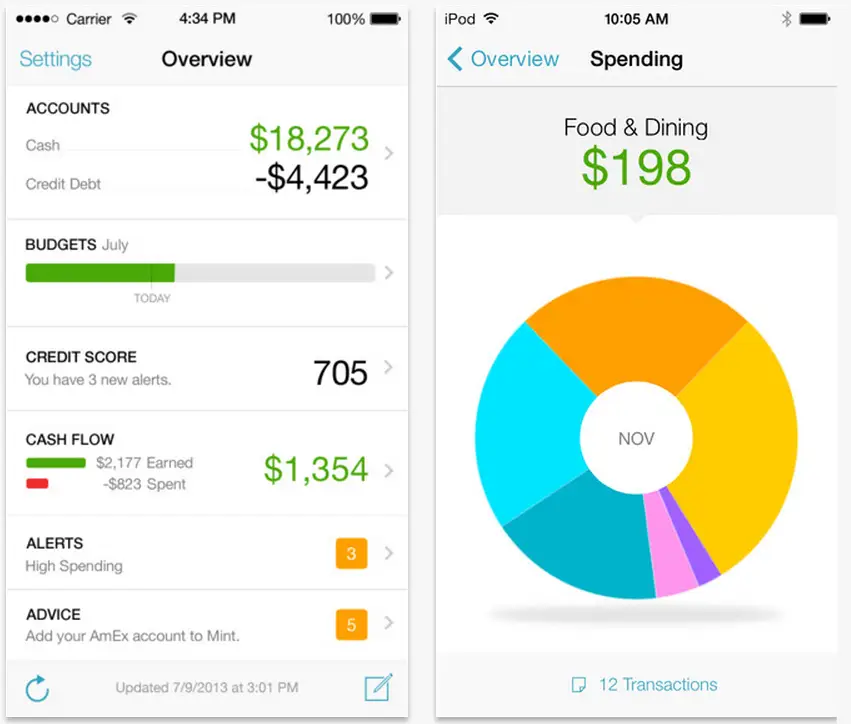

Create a list of weekly expenses. Include everything, even the little things. For example, if you’re on a tight budget and can’t afford to go out to eat every night, don’t forget about your morning coffee and lunch with friends at work; if you go out often for drinks after work, it might be worth adding them to this budget as well. You can do this on paper or on an app like Mint or YNAB (you need both).

Commit to your budget.

Your commitment to your budget is the key to success. The more you commit, the better you’ll do. Conversely, if you don’t commit to it, chances are pretty good that things won’t go well!

You need to believe in your plan and ensure everything is going according to plan before making any decisions or taking any actions.

Use cash.

For many people, a paycheck is the easiest way to budget. You get a certain amount of money every week and know exactly how much you have at the end of each month.

But cash has its disadvantages: It’s physical! If you lose your wallet or forget where in your car it is, then suddenly, that money is gone forever.

By contrast, debit cards are digital; there are no stored credit card numbers anywhere, so fraud isn’t an issue either way—but even though debit cards let us spend more than we’d like without worrying about overdraft fees later on down the road (and sometimes even without any interest charges), many people still prefer using cash for purchases because it helps them stay within their budget limits better than electronic payment methods do

Create a savings account.

If you don’t have a savings account, create one. It’s easy to save money when you have a dedicated place for it, and there’s no temptation to spend it on other things. So, for example, if you’re saving up for a vacation or even just a new car, make sure that the money goes into your savings account instead of going toward anything else (like buying clothes).

If you want to wait to set up an actual bank account because it seems too complicated and time-consuming, there are other options: One option is using an app called Digit (available on iOS devices). It allows users who do not have access to banks or credit cards yet still want better financial management tools than cash-only options such as prepaid debit cards or money orders.

Ask your employer for direct deposit.

Direct deposit is a great way to ensure you receive your paycheck on time every week. It’s also the easiest way to budget because it goes straight into your bank account so that you can use it for anything: groceries, gas money and more!

If your employer doesn’t offer direct deposit and they don’t have plans to start offering it soon (or ever), ask them about setting up an electronic transfer of funds through payroll processing companies like ADP or Paychex. This facility will allow them to deposit each paycheck directly into your account without having access or control over how much money gets sent out at any given time.

Set Specific Goals For Your Money

Once you’ve budgeted your income and expenses, it’s time to set goals for each category. For example, if you’re trying to save money for a new car, set a goal of $2,000 by the end of next week. This effort will help keep you motivated since it’s something tangible that can be achieved quickly (within ten days). Likewise, if any debts need paying off ASAP but need to be urgent enough to put on hold later this month/year/etc., these should also be included in your weekly budgeting strategy!

Separate Needs And Wants

You may have heard the phrase “spend less than you earn”, and that’s a good thing! It means you should put away money for savings or retirement, so your needs are covered first. So, for example, if you need food and water every day (or at least once a week), those expenses should prioritise purchasing items like clothes or electronics that don’t matter if you don’t have them.

The same goes for other things. So, for example, if you want something but don’t have any money left after paying your monthly rent, you should wait to buy it because there’s nothing left to spend on anything else afterwards.

Pay Off Debt Immediately

Don’t use a credit card for any reason. Whether you’re paying for groceries, buying an emergency item or even taking out the trash, don’t use a credit card to pay for these things because you will only have extra money left after paying off your debt.

Make sure that all your bills are paid off on time each month so that no late fees or interest charges are added. Try to set up automatic payments from your checking account into another account where you can easily access it (such as savings). This way, there will be no excuse as long as everything goes smoothly!

Divide Your Money Into Categories

Now that you have a basic idea of how much you need to pay each week, it’s time to start budgeting. The first step is to divide your income into categories. This discipline will help you determine which expenses are more important and can be reduced if necessary.

- Budgeting requires discipline, so every dollar goes into the right category!

- If there isn’t enough money left over in any category, cut back on spending elsewhere until there is enough for all of them again (or until a new job comes along).

Put Money Towards Savings

The foremost importance of budgeting on a weekly paycheck is putting money toward savings. There are many reasons why it’s important to save:

- You want to maintain control of your finances if you’re ever faced with an unexpected expense.

- Saving puts money in your pocket regarding spending (which can be fun).

- Having an emergency fund helps prevent financial emergencies from happening in the first place, which will make your life so much easier overall.

Saved as a favorite, I really like your blog!

Thanks