Money is any item or verifiable record generally accepted as payment for goods and services and repayment of debts in a particular country or region. A central bank, financial institution or the government may issue various types of money to the citizens. Paper money is paper money, and coins are coins; however, some countries differentiate between notes and coins when considering their monetary policy.

Coins

Coins are made of precious metals or other materials that you can use to make a change. Coins come in different denominations, with 1-cent coins being the most common.

You might have seen your change at the grocery store or a restaurant—coins are often accepted as payment for small purchases and services, such as buying a cupcake in a bakery or ordering food delivery from an app like Seamless.

Bills

Bills are legal documents that authorize a person to take money out of your bank account. You can use them for any purpose, but they’re most commonly used for paying bills or purchasing.

A promissory note is similar to a bill; it allows someone else to take possession of your money and use it as they see fit (for example, if you’re planning on travelling abroad). However, a promissory note only lasts until the date written on its face—if something happens between then and now (like if you don’t pay), the seller can sue for payment or return their goods or services.

Bank notes

Bank notes are the most common form of money, and they come in two main types:

- Demand deposits. These are bank accounts that people can access anytime, but they’re not backed by gold or silver. They promise to pay you back when you want to take them out of your account, but they don’t have legal tender status (meaning no law says this specific amount has any value).

- Fixed deposit accounts. These are similar to demand deposit accounts except for one thing. You must put down a certain amount of money upfront before opening up an FD account; otherwise, your funds will be returned if you choose not to use them within six months after opening it!

Scrip money

Scrip is a type of money that people used in ancient Greece, Rome and other parts of Europe. It’s often called a “currency” or “coin,” but these terms can be misleading because scrip has no value. Scrip is not an actual currency—it’s just a piece of paper with an image representing something else (like gold).

In ancient Greece and Rome, scrip was created when government officials issued new coins made out of lead instead of silver or gold. These coins were called ‘scrip’ because they were treated like documents (i.e., they were legal tender). A person with scrips could exchange them with merchants at face value for goods and services such as food items or clothes; however, they could only use them directly as payment if they had another form of currency handy, like coins made out of silver or gold!

Bill of exchange

A bill of exchange is a document that orders a third party (the drawee) to pay a certain amount of money to the person who holds the bill (the payee). The payee can be an individual or an entity.

The bill requires three things:

- The name of the drawee who will take payment on behalf of another party;

- The amount owed by them; and

- An address where they want their money sent

Promissory note

A promissory note is a written promise to pay a specified sum. You can use it in business transactions, personal finance and even loans.

The first use for promissory notes was in commercial loans—when you borrow money from your friend or relative, they will give you one as collateral for their loan. Then, if you pay them back on time with interest, they get paid twice: once from the original payment plus interest earned by waiting; and again when they sell their collateral (the note).

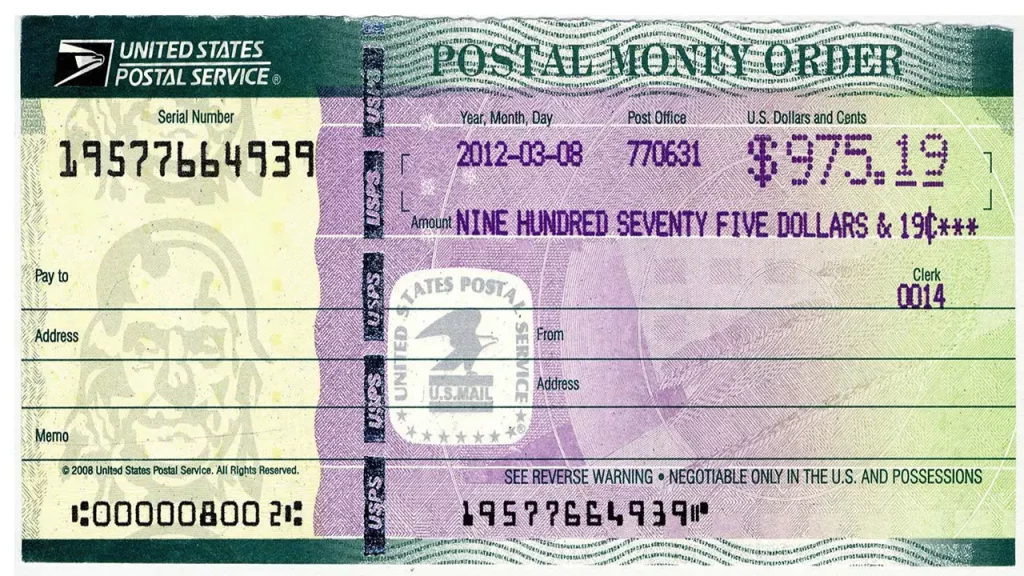

Money orders, postal orders, and money transfers (settlement)

A money order, postal order and money transfer are all prepaid instruments.

A money order is a type of check paid for by the purchaser and sent to a payee. The purchaser deposits the amount of their money order into their bank account and then pays it out as needed when they use it to make purchases or withdraw cash from an ATM. If you purchase something online using your credit or debit card, this can be considered an electronic payment rather than a paper payment.

Postal orders typically cost more than checks because they require extra processing time (usually 3-5 business days) before delivery. However, there may also be fees associated with this service depending on how quickly someone needs them to complete their transactions.

Conclusion

Money is a key part of our economy and an important part of our everyday lives. Of course, we rely on it to pay for groceries or gas, but we also use it as a medium when buying and selling things. In this article, we have discussed different types of money and their uses.

Add Comment